Latest News

The latest news from France Tax Law.

20 October 2023

Using a Civil Company (SCI) for Property Investment in France

Read More

13 October 2023

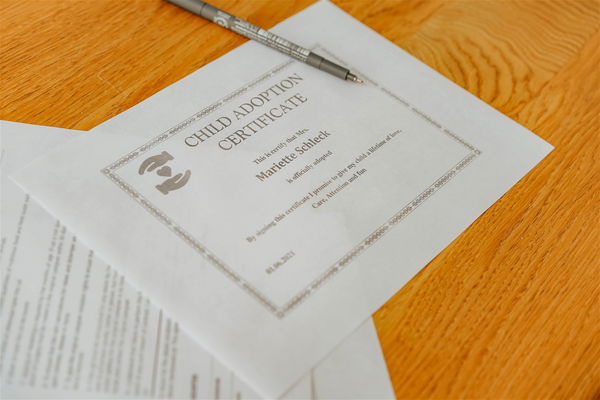

Adoption in France: Adopted Child Inheritance Rights Explained

Read More

18 August 2023

Can You Inherit Debt In France?

Read More

23 June 2023

What Is Présent D'usage?

Read More

19 May 2023

Separation of Assets in France

Read More

31 March 2023

Investing In French Property - Which Areas Are Best?

Read More

3 March 2023

Can I Get A UK Mortgage For A French Property?

Read More

7 February 2023

The Importance of the Tontine Clause in the Purchase of French Properties

Read More

16 December 2022

How Has Brexit Affected Selling Property in France?

Read More

3 November 2022

Notaire Fees Explained

Read More

7 October 2022

How To Move To France Post - Brexit

Read More

29 September 2022

Living In France: Family Life

Read More

30 August 2022

French Power of Attorney: Explained

Read More

2 August 2022

6 Things You Didn't Know Were French

Read More

1 July 2022

5 Things To Consider When Buying Commercial Property in France

Read More

24 June 2022

France vs England: Differences in Business Culture

Read More

16 June 2022

Deciding Factors When Buying A Second Property In France

Read More

23 May 2022

What Is A French Notaire, And How Can They Help You?

Read More

27 April 2022

The conditions for simple adoption in France with an extraneity element

Read More

28 March 2022

Getting Married in France? Here is What You Need to Know

Read More

11 March 2022

Top 5 Reasons To Use A French-Speaking Notary

Read More

4 March 2022

Your Guide To The English Channel Fishing Rights Row

Read More

17 February 2022

WHAT IS MY STATUS?

Read More

9 February 2022

NOTAIRES

Read More

17 January 2022

Keeping Your Affairs In Order In France

Read More

13 January 2022

PROPOSALS ON INHERITANCE TAX

Read More

17 November 2021

FREQUENTLY ASKED QUESTIONS: LAW 2021-1109 OF AUGUST 24, 2021 CONFIRMING THE RESPECT FOR THE PRINCIPLES OF THE REPUBLIC

Read More

10 November 2021

General procedures for purchasing a French property

Read More

22 October 2021

What to Expect in a Post - Brexit World in France

Read More

22 October 2021

English and French Wills, Do You Need Both?

Read More